The state of the economy might change significantly from one to the next. Without thinking about the significant issues, acquiring a complete view of a particular area is challenging. Knowing the average credit score in a state can help current residents evaluate how they stack up against their peers, and prospective movers can get a better idea of whether or not they'd be financially comfortable there. Business prospects inside a state may also be evaluated using this metric.

The State-By-State Average Credit Score

Understanding Credit Scores

To put it simply, a credit score is four different numbers used by financial organizations to evaluate an individual's creditworthiness; this number is usually updated monthly. The three credit reports provide information to determine your credit scores, such as your total debt and the number of outstanding debts. A credit score of 850 is the best achievable, and scores below 300 are considered flawed. A better credit score indicates a greater propensity for borrowers to meet their financial obligations to lenders. It can significantly impact the cost of insurance and loans and your eligibility for these products. High-interest rates and insurance premiums are charged to persons with low credit scores because of the higher risk to lenders.

State Averages

The three figures that make up your credit score are the most significant numbers you'll ever see. When considering if they should extend credit, 90% of financial institutions look at a borrower's credit history. Whether you're looking to rent or buy, your credit score (like the widely used FICO scoring system discussed in this article) will play a role in determining how likely you are to get approved for either. It's the deciding factor when applying for a loan or purchasing a car. Your credit score affects your ability to do something as commonplace as buying a cell phone. Even seemingly harmless and circular behaviors, such as authorizing an enquiry on your home loan, can affect your credit score. One factor that can affect your credit rating is where you live. Different regions of the United States have additional credit score requirements, and this article will examine those differences and the factors that cause them.

Why FICO?

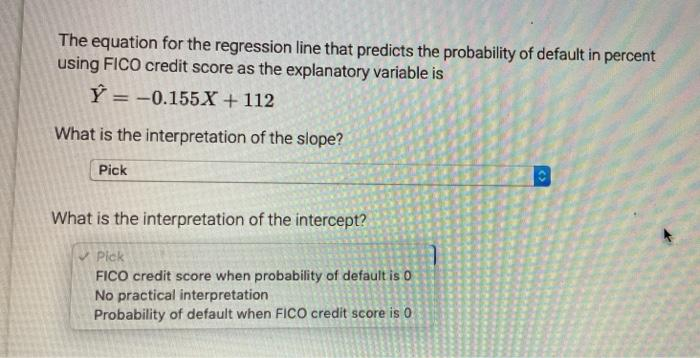

The Good Isaac Private Organization, popularly known as FICO, was the organization that was responsible for the initial development of the FICO score in the year 1989. Because FICO scores underpin over 90 per cent of loans in the United States, these scores are considered the most reliable measurement of the economic stability of both regions. Creditors look at the repayment history of individuals, the overall amount on unsecured balance, the forms of credit used, this same duration of the credit score, and the quantity of recently formed accounts when establishing a person's FICO score. This sheds light on various reasons that could account for the disparate credit ratings assigned to the various states.

The FICO Score and Annual Household Income

The Board of Reserves in the Banking System found in 2018 that there was an intermediate link between household expenditure and consumer credit rating. This would imply that credit access gaps could increase if income inequality continued to rise. A better credit score indicates a greater propensity for borrowers to meet their financial obligations to lenders.It's not a coincidence that the South has lower average credit scores. In the United States of America, in the year 2020, According to the Census Bureau, 16 out of the 20 wealthiest states in the United States in the previous year were situated in the South.

Conclusion

It is essential to remember that the single most crucial factor in determining your credit score is you, not the state of the economy in the region where you happened to be residing. To calculate the average of a collection of numbers, add all of the numbers together again and divvy the sum by the total amount of digits in the foreground. This will give you the average of the numbers. Most numbers will be relatively close, but outliers are still possible. If you want a credit score at the very highest point on the scale, you need to keep up with your payments and reduce the amount of debt you have.

Directional Trading: What is it?

What Is the Annual Equivalent Rate (AER)?

A Guide About What Is a Credit Card Issuer?

How to Request an Increase in Credit Card Limit

VA Renovation Loan: The Home Improvement Loan For Veterans

Explain Loan Servicing?

Smart Money Podcast

The Best Review of NJM Auto Insurance 2022

Betterment Vs. Fidelity Go: Which Is Better For You?

Top 10 Factors to Determine Auto Insurance Rates

CP05 Notice From the IRS: What It Is and What You Need To Do